Spain is located on the Iberian Peninsula and includes two archipelagoes: the Canary Islands and the Balearic Islands. With more than 195,000 square miles of land, Spain is the largest country in Southern Europe and the second largest in the European Union (EU).

The country is home to more than 49 million people and has multiple co-official languages along with Castilian Spanish in recognition of its diverse communities, including Catalan, Galician, Basque, and Occitan.

The culture of Spain is based on a variety of European-based cultures of historical influence, primarily based on pre-Roman Celtic and Iberian culture.

Spain is a member of multiple global organizations including the United Nations, the EU, the Council of Europe, and NATO and is a de factor member of the G20 summits.

The Euro is the official currency of Spain. The Euro was launched in two stages. First, in January 1999, to become the new official currency of 11 EU Member States, replacing the old national currencies—such as the Italian Lira. It was introduced in the virtual form for bank transactions.

The tax year in Spain follows the calendar year. The tax collection method depends on the tax; some of them are collected by self-assessment, but others (i.e., income tax) follow a system of pay-as-you-earn tax with monthly withholdings that follow a self-assessment at the end of the term.

Labor Standard Act or Employment Act

The organization of working time (maximum weekly or daily working hours, rest time during the working day, annual holidays, public holidays, paid leave, and overtime) is regulated by law (Statute of Workers’ Rights); the working day is regulated by agreement between workers’ and employers’ organizations or in contracts. The Ministry of Employment and Social Security manages labor issues.

Employment is highly regulated in Spain, and labor inspections do occur. It can be very expensive for you to fire an employee in Spain if you haven't followed the proper procedures.

Working Hours

The normal working hours must average 40 hours per week maximum of actual work, calculated on an annual basis.

The actual number of normal working hours may never exceed nine per day unless a collective agreement or an agreement between the company and workers’ representatives establishes a different distribution of daily working time, which must, in any event, respect the rest time between working days.

Employees under 18 years of age may not do more than eight hours of actual work per day, including hours allotted to training, where applicable, and the hours worked for different employers if they work for more than one employer.

Working hours may be distributed irregularly throughout the year under the terms of a collective agreement or an agreement between the company and the workers’ representatives provided the minimum periods of daily and weekly rest are respected.

National Holidays

National holidays are set on an annual basis. There are 10 per year, two of which will be local holidays. New Year's Day, 1 May (Labour Day), and 12 October (Spanish National Day) will be observed as national holidays (see Table 1). Any national holidays falling on a Sunday will be transferred to the Monday immediately following.

Each municipality has a total of 13 public holidays per year—up to nine are chosen by the government, and at least two are chosen locally. You can view a complete list by region here.

Each municipality has a total of 13 public holidays per year—up to nine are chosen by the government, and at least two are chosen locally. You can view a complete list by region here.

Holidays may be agreed upon individually or collectively and may not be fewer than 30 calendar days. Holidays cannot be replaced by financial compensation. When workers with casual or temporary contracts cannot take the legal minimum holidays because they do not work for the company during holiday periods, they will receive a pro-rata payment for the holidays with their wages.

The holiday schedule is fixed in each company. Workers will be aware of the relevant holiday dates at least two months prior to their commencement, and if there is disagreement they may present a claim to the employment tribunal.

Time Off

Maternity/Paternity Leave

Maternity leave for a woman will last 16 uninterrupted weeks, which may be extended by two weeks for multiple births for each child from the second child onward. This period may be taken at the discretion of the person concerned, provided that six weeks fall immediately after the birth. Irrespective of this obligatory post-birth time off for the mother, if both parents work, the mother may opt for the father to take a specific uninterrupted portion of the leave after the birth. Maternity and paternity leave are the same.

Annual Leave (Vacation)

Paid leave is subject to notice and subsequent justification to the company. Workers may take paid time off for some of the reasons listed below with the number of days allowed:

- Birth of child or death, accident, or serious illness or hospitalization of relations, two calendar days or four if required to travel.

- Moving to a new house, one day.

- Women are entitled to one hour off work each day for breastfeeding a child under 9 months of age, or half an hour if taken at the start or the end of the day. This time off may be taken by either the mother or the father if they both work.

- Meeting public and private obligations (jury service, appearance in court, etc.), if necessary.

- Performing trade union or workers' representative activities: as established by law or collective agreement.

In every case, the worker must inform the employer in advance and justify his or her absence to be able to enjoy the right to take time off work.

For the purposes of labor law, the performance of jury duties is treated as an unavoidable public and personal duty.

Minimum Wage

Spanish Prime Minister Pedro Sánchez, with the backing of Podemos leader Pablo Iglesias, has agreed to increase the current minimum wage by around 22% in the 2019 budget.

The increase will be the biggest in 40 years and will mean that the net monthly minimum wage will rise from the current amount of €733 per month to around €900 per month.

Overtime Pay

Overtime is hours of work carried out over and above the maximum number of normal working hours. Workers may work a maximum of 80 hours of overtime per year, which does not include overtime compensated with rest time, or work carried out to prevent or repair extraordinary and urgent damage. The latter is obligatory for the worker and must be paid as overtime.

Overtime at night is prohibited, except in duly-specified and expressly authorized special activities. It is also prohibited for people under 18 years of age.

Overtime may be remunerated or compensated for with equivalent paid rest time.

If the worker works for fewer hours per year than the general company working hours, the restriction on hours is reduced proportionally.

Employee Work Contracts

There are different types of work contracts for employees working in Spain:

- Indefinite contracts. This includes the normal indefinite contract as well as several types of indefinite contracts with government incentives.

The main characteristics of the normal indefinite contract are:

- Temporary work contracts. These types of contracts include:

- Contract for a specific project or service, arranged for performing work or providing a service which is temporary but of uncertain duration.

- Casual contract due to production overload or backlog. The maximum duration of this type of contract is six months in any twelve-month period.

- Contract to sit in for employees entitled to return to their job. The duration of this contract is the period during which the absent employee retains the right to return to his or her job.

- Work experience contract. This contract can be arranged with university or junior college graduates or persons with vocational qualifications or recognized equivalent qualifications, provided that not more than four years have elapsed since they completed the related training. The duration is from six months to two years.

- Trainee contract. This type of contract can be arranged with workers aged 16 to 21 who do not have the necessary qualifications to obtain a “work experience contract.” The duration of this contract ranges from six months to two years, although it may be extended to three years by a collective labor agreement. Transitory employment needs may be met through workers provided by temporary work agencies.

Income Tax Filing

Residents

There has been no change to income tax withholding in Spain for two years. With the election of a new government for 2019 led by the Socialist Party, we should expect to see some change in this area.

Spanish resident employers and permanent establishments in Spain of nonresidents are obliged to make withholdings of taxable income paid to their employees. The withholdings are made in accordance with a previous estimation of the final tax due. If the employees work for a Spanish-related company or permanent establishment in Spain of the nonresident company, the withholdings must be made by the Spanish entity or permanent establishment for which the employee works.

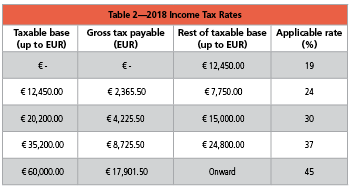

The withholdings on employment income are calculated according to a progressive scale based on the amount of taxable income that is expected to be paid during the tax year (both cash and in-kind remuneration must be considered) and the family status of the employee. If said circumstances were modified during the tax year, a new calculation must be made.

The withholdings on employment income are calculated according to a progressive scale based on the amount of taxable income that is expected to be paid during the tax year (both cash and in-kind remuneration must be considered) and the family status of the employee. If said circumstances were modified during the tax year, a new calculation must be made.

These withholdings are paid to the Spanish tax authorities on a monthly or quarterly basis and will be deducted from the employee’s final tax due. If the total amount of withholdings exceed the tax due, the tax authorities will have to refund the difference. After deducting withholdings, the tax due is paid on the filing of the tax return. However, the resident taxpayer can choose to pay 60% of the tax due when the return is filed and the remaining balance in November. Withholding obligations in the case of nonresident entities must be checked on a case-by-case basis. Those individuals engaged in independent or business activities must make certain prepayments of the final tax throughout the year.

Nonresidents

In general, nonresident taxpayers are taxed at a flat rate on income obtained in a Spanish territory or which arises from Spanish sources.

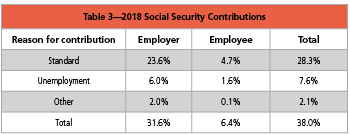

In addition to income tax, there is a social security tax that must also be paid by employees and employers (see Table 3).

In addition to income tax, there is a social security tax that must also be paid by employees and employers (see Table 3).

Payment Due Dates

Depending on the tax and the liable taxpayer, periodic self-assessments must be filed:

- Quarterly—For individual business people taxed under the objective evaluation or direct evaluation method, professionals, and for companies and entities that are not legal persons.

- Monthly—For sole traders, professionals, companies, and non-legal entities with a turnover greater than €6,010,121.04 in 2017 (large businesses) and for VAT taxpayers required to keep record books on the Tax Agency E-Office and Public Administrations, including the Social Security.

Do you like our content? Join the GPMI community to get free education and articles straight to your inbox!

Dee Byrd, CPP, PHR, SHRM-CP, is a Project Manager for PayTech, Inc., who has more than 25 years of global payroll management experience and has represented the payroll profession by speaking to the U.S. Congress in matters regarding multistate payroll taxation issues. She is an American Payroll Association (APA) Vice President, a member and past chair of the APA’s Electronic Payments Committee, part of the APA’s Payroll Cards Subcommittee of the Government Relations Task Force (GRTF), a member of the APA’s Global Issues Subcommittee of the Strategic Payroll Leadership Task Force (SPLTF), and a member of the APA’s Board of Contributing Writers. She was also the APA’s 2011 Payroll Woman of the Year.