Bulgaria is a southeastern European country bordered by Romania to the north, Serbia and Macedonia to the west, and the Black Sea to the east. Its capital and largest city, Sofia, is more than 7,000 years old and as one of the oldest cities in Europe saw several historic empires, including the Greeks, Persians, Romans, and the Ottoman Empire. The country’s rich culture has enduring influences from these civilizations that can be seen today in its food, music, and traditional dance.

Bulgaria is a southeastern European country bordered by Romania to the north, Serbia and Macedonia to the west, and the Black Sea to the east. Its capital and largest city, Sofia, is more than 7,000 years old and as one of the oldest cities in Europe saw several historic empires, including the Greeks, Persians, Romans, and the Ottoman Empire. The country’s rich culture has enduring influences from these civilizations that can be seen today in its food, music, and traditional dance.

Bulgaria has a population of 7.2 million people and is a member of the European Union, NATO, and the Council of Europe.

In 2015, Forbes listed Sofia, the economic heart of Bulgaria, as one of the top 10 places to launch a startup business due to its low corporate tax, extremely fast internet speeds, and the presence of several investment funds.

Applicable Law on Payroll Fees

The general provisions regarding the Bulgarian payroll system are settled in accordance with the Bulgarian Labour Code and Bulgarian Social Insurance Code.

Social Insurance Foundation

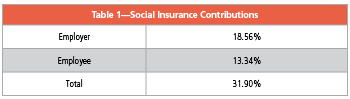

Social insurance contributions are paid on a monthly basis. The percentage of social insurance contributions depends on the activity of the employer—services, manufacturing, trade with goods, etc. View Table 1 for the most recent contributions.

The employer is obligated to pay the social insurance contributions each month by transferring the relevant amount to the bank accounts of the National Revenue Agency. When the payments are completed, the employer submits the necessary declarations for the accrued social insurances and the paid social contributions to the relevant authorities.

The employer is obligated to pay the social insurance contributions each month by transferring the relevant amount to the bank accounts of the National Revenue Agency. When the payments are completed, the employer submits the necessary declarations for the accrued social insurances and the paid social contributions to the relevant authorities.

Tax Deductions

The personal income of individuals is taxed at a flat rate of 10% of the net salary. Income tax is payable by the employer on behalf of the employee together with the payment of social insurance contributions.

Every additional payment (including bonuses) is subject to social insurance and taxes.

At the end of the year, every employer provides to employees a certificate for the total amount that has been paid on their behalf, including social insurance contributions and income tax.

Depending on the employer’s trade activities and the position held by the employee, there are set minimum social insurance bases. The maximum social insurance base as of January 1, 2017, is at Bulgarian lev (BGL) 2,600.00/EUR1,330.00.

Employment Procedure

The employer has the obligation to register employment contracts no later than three days after their signing, but not later than the starting date of the employee and no later than seven days after their termination. The statutory number of working hours per week is 40 hours. There is a separate procedure that needs to be followed in cases when a company is hiring a specialist from a non-EU country.

Protection of Employment

Holidays: According to the Bulgarian Labour Code, every employee is entitled to not less than 20 working days of paid annual leave. If there is an additional agreement between the employer and the employee, this period can be longer but not shorter. Some categories (such as university students) have additional paid days off. If the employment contract is terminated and the employee has unused days off, these days should be paid by the employer as compensation.

Holidays: According to the Bulgarian Labour Code, every employee is entitled to not less than 20 working days of paid annual leave. If there is an additional agreement between the employer and the employee, this period can be longer but not shorter. Some categories (such as university students) have additional paid days off. If the employment contract is terminated and the employee has unused days off, these days should be paid by the employer as compensation.

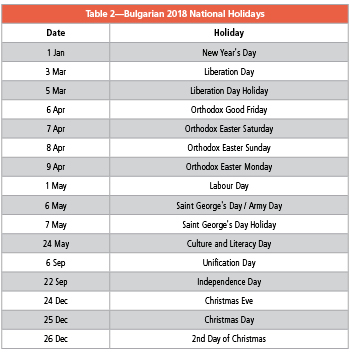

In addition to the 20 paid leave days, every employee is entitled to approximately 15 official holidays.

Illness: The compensation is payable by the government, except for the first three days, which are paid by the employer. The amount of compensation for the first three days is 70% of the gross salary of the employee. For days after that, the employee receives 80% of the average income of the past 18 months, which is payable by the state. In case of a work accident, this percentage is 90%. The employee should have not less than six months’ working experience to have the right to receive compensation from the state. The doctor has the obligation to submit the employee sick leave list to the authorities electronically, and the employer submits other relevant documents. Compensation is paid by the government within 14 days of its presentation.

For example, if the employee presents sick leave documentation to the employer on February 20, then the employer has obligation to submit it electronically to the government social insurance institution (NSSI) no later than March 10. NSSI will pay sick leave days in the next 14 days after the date of submission sick leave document by the employer.

Maternity: The compensation is payable by the government and is set at 90% of the income of the employee for the last 24 months of employment. It is payable for a duration of 410 days. The only obligation of the employer in such cases is to provide the maternity leave list to the government institutions.

Payroll Calculation Procedure

The monthly payroll calculation procedure consists of the following steps: Employees’ monthly working and sick days are calculated and compared in case there are additional leave applications and contracts. Bonuses or any other benefits are added to the gross salary. After the necessary calculations and deductions are made, the necessary printouts are generated. The payroll file, social insurance payment orders, as well as salary payment orders (if necessary) are sent to the employer. When the payroll calculations are completed, two extra declarations are prepared and submitted to the National Revenue Agency. In case of illness and after the declarations have been submitted, the sick leave list must be prepared and submitted not later than the 10th of the following month after receiving it.

Termination of Employment

Employment termination may occur with a notice of one, three, or six months based on the employment contract. After termination of the contract, the employer is obliged to provide to the employee all the relevant documents, including the certificate for paid social insurances and income tax and a filled-in labor book.

Rossitza (Rossi) Koleva holds the position of Country Executive at Eurofast Global Sofia. Koleva is responsible for overseeing Eurofast operations and the day-to-day provision of high-quality services to clients in Sofia. She assists the Regional Eurofast team to implement new business development and marketing initiatives. In recent years, Koleva has been involved in Eurofast's payroll service line at a local as well as regional level. She is fluent in Bulgarian, English, and Greek.